Choosing the Best Broker for Forex Trading: A Comprehensive Guide

In the world of Forex trading, choosing the right broker can make a significant difference in your trading journey. With numerous options available, it can be overwhelming to determine which broker best fits your needs. This guide will help you navigate the landscape of Forex brokers and highlight the essential factors to consider. To assist you in this endeavor, you can refer to the best broker for forex trading Forex Broker Register, which provides detailed information on various brokers.

Understanding Forex Trading

Forex, or foreign exchange, is the process of exchanging one currency for another. It operates 24/5, providing traders with abundant opportunities to profit from currency fluctuations. Unlike traditional financial markets, the Forex market is decentralized and operates through a network of banks, brokers, and individual traders.

Importance of Choosing the Right Broker

Your choice of broker can influence your trading performance significantly. A reputable broker offers a secure environment for your funds, efficient trade execution, and robust support. On the contrary, a poorly chosen broker may expose you to risks, including potential fraud or unfavorable trading conditions.

Key Factors to Consider When Choosing a Forex Broker

1. Regulation and Trustworthiness

Regulation is one of the most critical factors to consider. A regulated broker adheres to strict financial standards, which can protect your investment. Look for brokers regulated by reputable authorities such as the Financial Services Authority (FSA) in the UK, the Commodity Futures Trading Commission (CFTC) in the US, or the Australian Securities and Investments Commission (ASIC).

2. Trading Costs and Fees

Understanding the costs associated with trading is essential. Brokers typically charge spreads (the difference between buying and selling prices) and may also have commissions. Ensure you compare the trading costs between different brokers to find the most cost-effective option for your trading style.

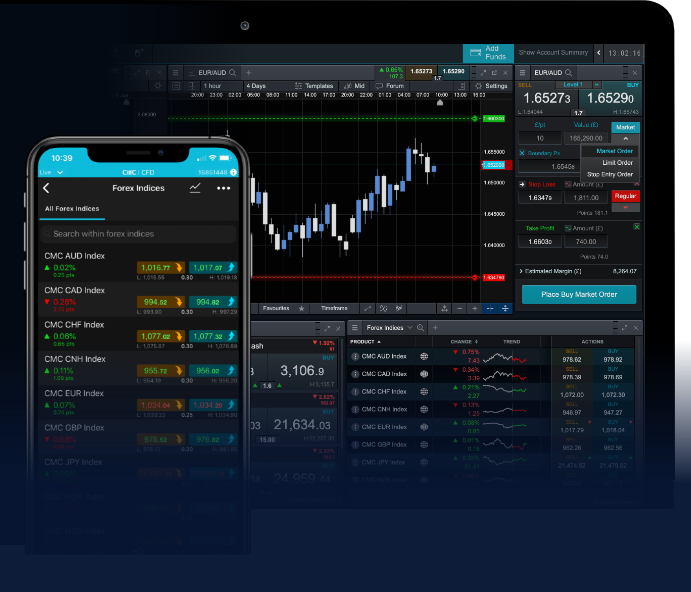

3. Trading Platform

The trading platform is where you will execute trades, so it should be user-friendly and reliable. Popular platforms include MetaTrader 4/5 and proprietary platforms offered by brokers. Test the platform through a demo account to ensure it meets your needs before committing real money.

4. Currency Pairs Offered

Not all brokers offer the same range of currency pairs. If you’re interested in trading exotic pairs or specific currencies, ensure your broker includes them in their offerings. A diverse selection can enhance your trading strategy.

5. Customer Support

Good customer service is crucial, especially for new traders who may have questions or face issues. Check if the broker offers multiple support channels, including live chat, email, and phone support, and ensure they are responsive to inquiries.

6. Leverage Options

Leverage allows traders to control larger positions than their account balance would normally permit. While it can amplify profits, it also increases risk. Brokers often offer varying leverage ratios, so consider how much risk you are willing to take when choosing your broker.

Evaluating Forex Brokers

Once you have identified potential brokers based on the factors above, it’s time to evaluate them further. Use the following methods to assess each broker:

1. Online Reviews and Ratings

Read reviews and ratings from other traders to gauge their experience with specific brokers. Look for feedback on reliability, customer service, and overall satisfaction.

2. Demo Accounts

Many brokers offer demo accounts that allow you to practice trading without risking real money. Use these accounts to test the broker’s platform, investigate their execution speed, and assess their trading conditions.

3. Educational Resources

A broker that provides educational resources can significantly benefit new traders. Look for webinars, tutorials, and market analysis that can enhance your trading knowledge.

The Bottom Line

The best broker for Forex trading is one that aligns with your trading style, goals, and risk tolerance. Take your time to compare different brokers based on regulatory status, trading costs, platform usability, and available support. Using resources like the Forex Broker Register can also help streamline your decision-making process.

Always remember that trading is inherently risky, and you should only trade with money that you can afford to lose. By selecting a reliable broker, you can create a conducive environment for your Forex trading journey.